Our mission is to foster financial and intellectual independence for our children.

Amaya Growth Fund

Our mission is to foster financial and intellectual independence for our children.

Amaya Growth Fund

Behind Us

To be the primary care giver and provider for our children and families

To nurture them to become good human beings and global citizens

To protect them from harm

To provide financial and intellectual freedom

Philosophy

Capital

Preservation

Avoid investment in companies with significant debt, poor corporate governance standards, regulatory and key man risk

Socially

Responsible

Avoid investments in sin stocks (companies that engage in activities that can be harmful, such as tobacco, alcohol, and firearms as well as large polluters)

Capital

Appreciation

Investment in companies with strong growth and return prospects (market leaders with strong moat, consistent historical returns and proven profitability)

Dividend

Payout

Investment in companies with robust & consistent cash flows and stable dividend payouts

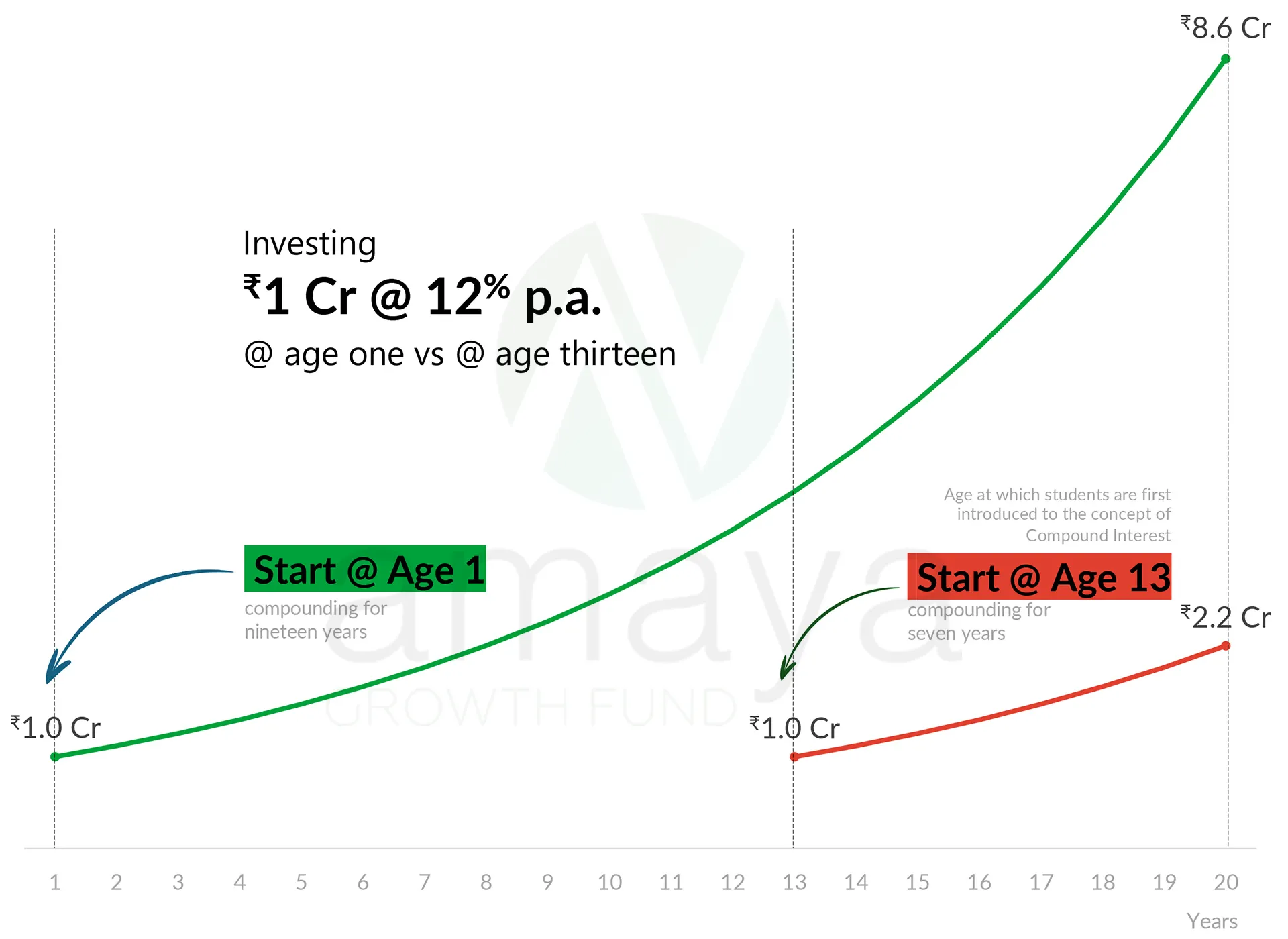

Compounding grows wealth by reinvesting returns for even greater returns.

Starting early maximizes its power, leading to exponential growth and long-term wealth creation.

Early investment is vital for any successful financial strategy.

Amaya will help you plan/protect your child’s financial independence via

1. Fostering Financial Literacy

in your child from the start through educational initiatives

2. Investing & Generating Returns

on your purpose-built savings corpus and protecting it against potential cost inflations

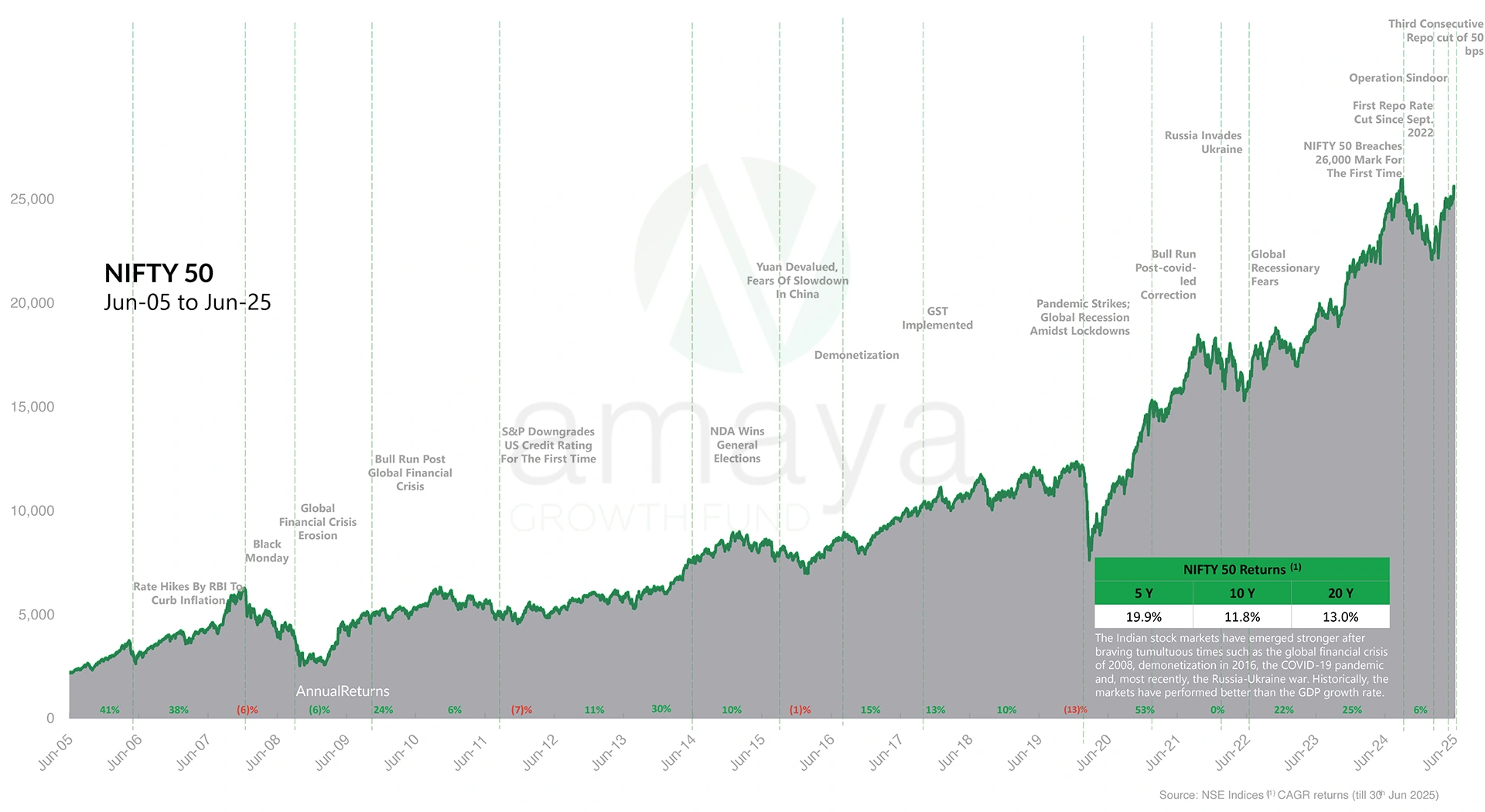

Public Equities (India) Asset Class

Consistent Wealth Compounder Over The Past Two Decades

Amit Khanna

Chief Investment Officer

Charted Accountant

ISB Indian School Of Business

Harvard Business School

IMD, Lausanne

Over two decades of experience as an entrepreneur, investor, business leader and adviser across Real Estate, Education, Financial services, Retail & Mining.

Formely ran, The Phoenix Fund (a SEBI registered Portfolio Management Scheme wht AUM of over $ 150 mn) and co-founded a debt fund 'IIFL Phoenix Cash Opportunities Fund'.

Also founded and ran InterGlobe Real Estate Fund as the CEO and General Partner and Managed an asset base of 1mn sft.

Agam Sarin

Vice President - Investments

MBA, Finance & B.Tech, Electrical Engineering

Symbiosis International University, Pune

VIT University, Vellore

Over 8 years of experience in M&A, Investments, Corporate Finance & Strategy vertical across Real estate, Education, Hospitality & ITES industry

Specializes in evaluating/advising on the investment opportunities and has previously advised family offices on investment opportunities across asset classes (including public equities)

Previously worked as an Analyst in the M&A and 'Investments' division of InterGlobe. Also worked in the Corporate Finance and Commercial Strategy division of a previous ITES holding of InterGlobe

Aman Sharma

Equity Research Analyst

MBA, Finance & Operations and B.Tech

XLRI Jamshedpur

IIT BHU, Varanasi

Three years of experience in bottom-up stock research and identifying tactical investment opportunities based on technical and/or macrolinked factors with a special focus on the BFSI sector

Experience of working as an equity analyst for a US based investment management firm

Also worked in the business finance division of RPG Enterprises and formerly, was an engineer in the engineering application division of the Dassault Group

Lovish Soien

Equity Research Analyst

MBA, Finance & Strategy – XLRI Jamshedpur

B.Com (Hons) – VNSGU

Over five years of experience in public equities across geographies and sectors with a focus on long term fundamental investing and specializes in identifying businesses with a sustainable competitive advantage.

Has previously worked with Dalmus Capital, an AIF with a concentrated portfolio and focus on small cap public equities in India, and Shannonside Capital, which advises a US based hedge fund with a concentrated portfolio and an AUM of $5bn.

Shatakshi Kapoor

Senior Manager - Legal & Compliance Officer

Bachelor of Arts - Bachelor of Legislative Law (H.)

Amity Law School, Delhi (GGSIPU)

More than 6 years of experience in delivering legal and strategic solutions across various industries

Substantial experience in handling intricate commercial transactions, addressing general corporate concerns, and leading contractual negotiations

Previously worked as Legal Associate in the General Corporate and Commercial Practice at Anand and Anand. Also, worked with Hindustan Coca-Cola Beverages Private Limited as Legal manager

Bharat Anand

Bharat Anand

Legal Amicus

Solicitor, England & Wales

B.A. (Law), Jesus College, Cambridge University

B.A. (Hons.) Economics, Hans Raj College, Delhi University

Bharat Anand is Senior Partner at Khaitan & Co (a leading Corporate Law Firm). He specialises in mergers & acquisitions, joint ventures, private equity transactions and growth equity investments in Unicorns.

A dual qualified lawyer (India and England Wales), Bharat read law at Jesus College, Cambridge, as a Cambridge Commonwealth Scholar and is an alumnus of St Columba’s School. He is ranked as “Band 1 Lawyer” for M&A work in Delhi, by both Chambers Asia Pacific and UK. He is based in New Delhi.

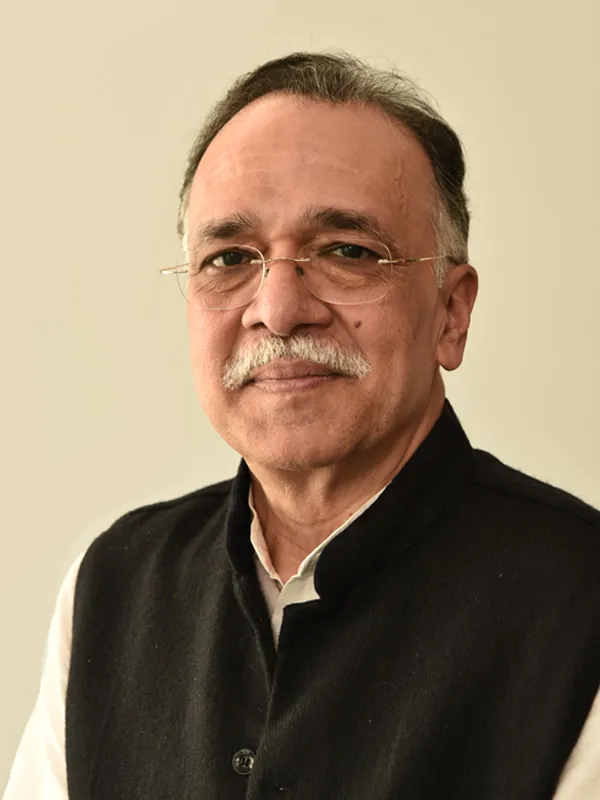

Pramath Raj Sinha

Pramath Raj Sinha

Founder

Founder & Trustee, Ashoka University

Founder & Chairman, Harappa Education

Founding Dean, Indian School of Business

Founder & Managing Director, 9.9 Group Pvt Ltd

Pramath is a pioneering force in Indian higher education. He is the Founder & Chairman of Harappa Education (now part of upGrad), which strives to become India’s largest online institution focused on teaching habits and skills critical to workplace success in the 21st century.

He is the Founding Dean and a member of the Executive Board of ISB which rapidly became one of the top-20 business schools in the world. He is also the Founder & Trustee of the acclaimed Ashoka University, a liberal arts university which launched the popular Young India Fellowship.

Pramath has been instrumental in setting up a wide spectrum of change-based higher education initiatives, including a management program for career-oriented women, an entrepreneurship fellowship for the Himalayan region, and a solution-focused design education for the built environment.

He has also been a media entrepreneur, education consultant and management advisor at the 9.9 Group, which he founded, and a Partner at McKinsey & Company.

Academics are his first love: He received a PhD and an MSE from the University of Pennsylvania and a BTech from the Indian Institute of Technology, Kanpur, where he was honored with the Distinguished Alumnus Award in 2018.

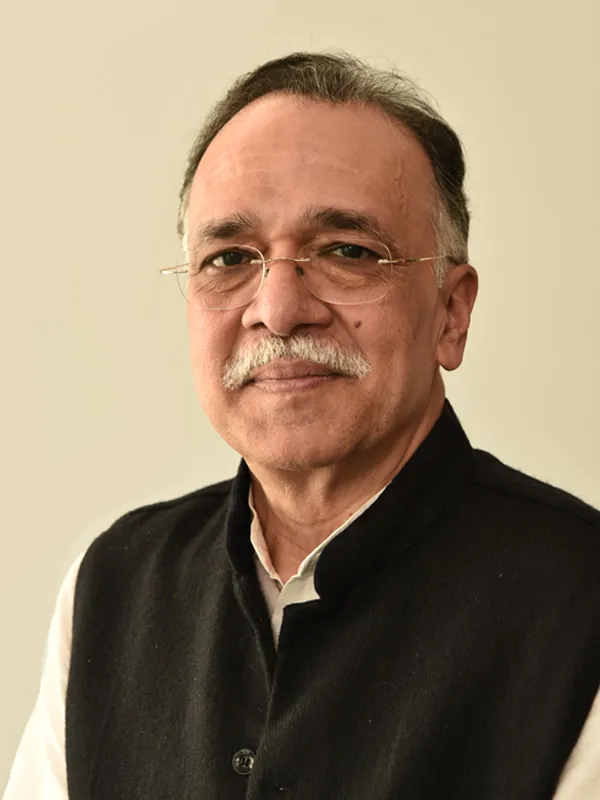

Sachit Jain

Sachit Jain

Vice Chairman & MD

Vice Chairman & MD

Vardhman Special Steels Ltd

Vice Chairman and Managing Director of Vardhman Special Steels Limited which is a part of the Vardhman Group having a turnover of around $ 1.5 billion.

Actively involved in CII since 25 years and past Chairman of the Northern Region.

Past President of the Ludhiana Management Association.

Founder and President of the Baddi Barotiwala Nalagarh Association (the largest industrial association in Himachal Pradesh).

Been involved in several government bodies in Punjab and Himachal Pradesh.

Total work experience of over 32 years.

Rajkumar Gopalan

Rajkumar Gopalan

Founder & CIO

Founder & CIO

Devish Capital

Raj is currently the CIO and founder of the Devish Fund, a global long/short hedge fund based in London and focused on the old economy sectors. The Devish Fund is managed within DSAM Partners (London) Ltd and is anchored by a large European family office.

Raj is a seasoned investor with over 18 years’ experience at top tier firms including DSAM, Naya Capital Management (Naya) and Goldman Sachs. He has had a particular focus on alpha generation within the old economy cyclical industries and experience starting, running and managing a successful start-up fund management business with Atlas Square Partners.

Raj began his career in 2004 with Goldman Sachs, initially as an analyst in the Industrials & Natural Resources Group within the Investment Banking Division (IBD) and then as an Executive Director in the Fundamental Strategies Group (FSG). At FSG, he managed a team of five people focused on proprietary investing opportunities across the capital structure in various global sectors including TMT, Industrials, Cyclicals and Consumer. In 2012, Raj joined Naya as a founding partner covering Commodities, Cyclicals, Industrials and Consumer sectors with additional input into portfolio construction and management. In 2017, Raj left Naya to help found Atlas Square Partners where he co-managed the portfolio with the CIO and headed up the research team. In 2020, he joined DSAM as a partner covering Commodities, Cyclicals, Industrials, Travel & Leisure and Business Services as well as China TMT. In his time at DSAM he had significant outperformance through to closure of the original funds in November 2021.

Raj has a Bachelors in Mechanical Engineering from Anna University (India), a Masters in Industrial Engineering from Purdue University (USA) and an MBA from the Indian School of Business (Hyderabad).

Hello!

We'd love to hear from you! Get in touch with our team at Amaya for any inquiries.

Quick Links

Amaya Investment Trust

Unit 3A, 3rd Floor

Aria Commercial Towers (JW Marriott Hotel)

Asset Area 4, Aerocity

New Delhi 110037, India

SEBI Regn. No. IN/AIF3/23-24/1290

Category III Alternative Investment Fund

Investment Manager - Phoenix Family Office Advisers Private Limited